The economic outlook in 2022 is set to be influenced by various economic trends that are likely to gain more prominence over the next few years. Several economic reforms will continue shaping economic policy.

Consider back to last year. Everyone was anticipating an economic recovery in 2021, all thanks to Covid-19 vaccines. Some predicted that the epidemic’s end was near.

Then the Delta and Omicron versions came along. The epidemic rages on, generating one confusing signal after another and posing significant challenges to the global economy’s recovery and shaping economic trends.

Market experts are concerned how much longer the bull market will continue—only interrupted by the shortest bear market in history, which ended in early 2020. Last call is drawing near, tempered by other signals that investors have money to make in 2022.

Here are the top nine economic trends to keep an eye on in 2022.

1. The Covid-19 Pandemic Is Still Shaping the World’s Markets

What will the pandemic’s winds bring? There’s a chance that normality will return in 2022, propelling travel, commercial real estate, and conventional retail equities even higher—but we’ve heard it before.

In 2021, Delta dashed the hopes of many. As the calendar rolls on, Omicron’s emergence raises both short- and long-term concerns. Social networking platforms, such as Facebook and Twitter, may be able to prevent further infections by spreading a message of health warning.

Even if this strain doesn’t cause another outbreak, what about the next one? Not human beings, but rather nature, will write the final chapter in this narrative.

Investors should be prepared for the post-Covid market rally, even if the pandemic isn’t over yet. That’s because stock markets have probably already factored in the majority of the economic gains that will be realized from a fully reopened economy and analyzed economic trends.

2. In 2022, the Federal Reserve is expected to raise interest rates

Stocks do well when interest rates are lowered by the Federal Reserve, but the days of the Fed’s zero interest rate policy (ZIPR) are numbered.

One of the most important economic trends for investors to consider is how many Federal Reserve interest rate increases will occur in 2022.

According to the FedWatch Tool from the CME, at least two rate hikes are expected, depending on how traders are betting in the futures market. Meanwhile, the already planned cuts in the Federal Reserve’s monthly bond purchases—often known as “tapering”—will take place by spring.

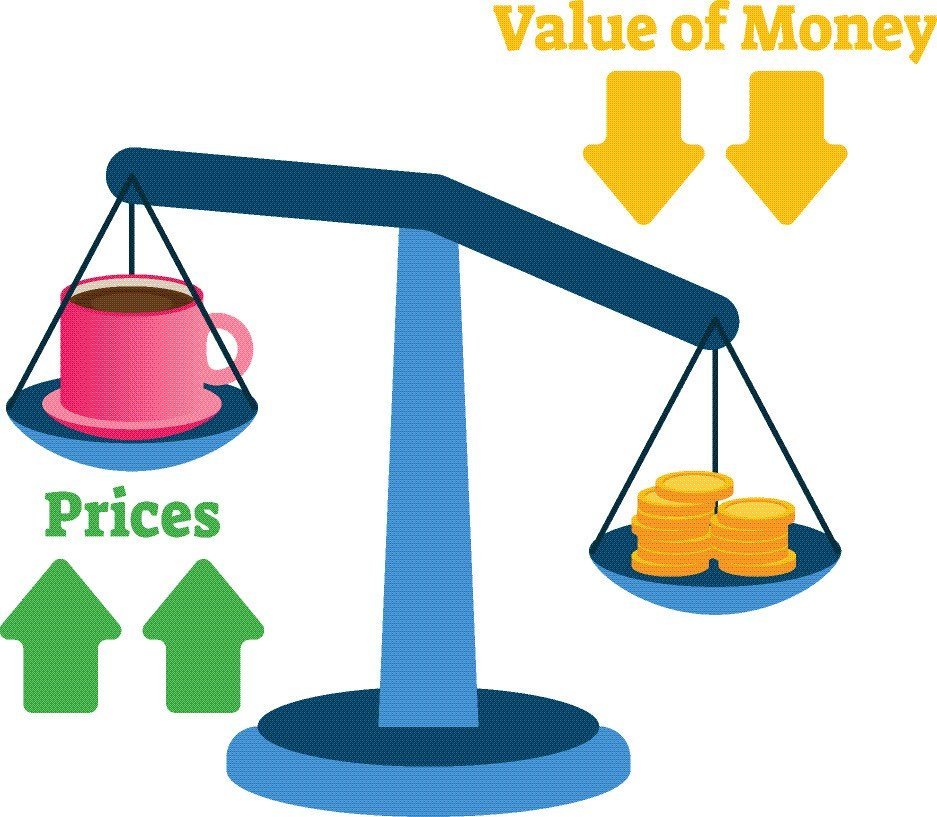

3. Maybe you’ve Heard It Enough Already: Inflation is a Serious Problem. It’ll only Get Worse before it Gets Better

It’s clear that Americans (and financial media) are preoccupied with price increases. In 2022, experts agree that high gas prices and supply-chain issues will not be readily dismissed as “transitory.”

Inflation will be a bigger topic in 2022, and if the present economic trends aren’t reversed soon, there will be market mayhem.

High interest rates and rising prices are a prescription for Wall Street shrinkage. It may signify possibilities in the bond market or even offer some encouraging news for savers in the form of higher APYs.

4. Supply Chain Solutions

You can check any US port today and find heaps of empty shipping containers or to be filled with items. This is just one sign that the supply chain problem isn’t a simple one.

There may be some benefits to supply chain difficulties in the long run. For the first time in a long while, Americans are reconsidering the wisdom and national security ramifications of buying and producing nearly all of our products in foreign countries. For the future it might abruptly change the country’s economic trends.

However, in the short term, it’s definitely bad for stock markets. Even if the pandemic comes to an end, there will be no full-term recovery until supply chains are repaired and store shelves are continuously restocked. The Omicron variant is not making the resolution of this problem any easier, ensuring that it will be there in 2022.

5. Recovery?

Underperformance of the current GDP growth rate in 2021 has frequently been overstated in the media.

The economy in the United States was cooking along in the first half of 2021, with 6% quarter over quarter GDP improvements. That’s unsustainable—and it was found out in the third quarter, when growth plummeted to 2%.

That was an early indication that the reopening dividend may have passed. A fourth-quarter rebound is expected, but imagine if 2022 arrives amid sluggish GDP growth during a time when the Fed is very concerned about price inflation. This could be a risky mix of economic trends for shareholders.

6. The Job Market Is Still in Flux

In 2021, the job market’s improved performance was a major topic. By November, the unemployment rate in the United States had dropped to 4.2 percent, confirming that the tight market was having a beneficial impact on pay rates.

However, the statistics conceal a deeper reality. After the pandemic, the United States has not yet recovered the 22 million jobs it lost during the epidemic recession, and it is millions of jobs short of where the job market should have gone on its pre-pandemic path.

The severe competition for employees has harmed businesses with higher labor costs and recruiting difficulties. Meanwhile, the market shift may have a negative impact on many public firms and economic trends.

It’s imperative to address these concerns before the labor market can return to normal—and it will continue to be another burden for many businesses.

7. Have the FAANG Stocks lost their appeal?

Look to the FAANG stocks for a genuine indication that the stock market may be slowing in 2022.

The five tech giants that have been a driving force behind the bull market for years now, including Meta—formerly Facebook (FB), Amazon (AMZN), Apple (AAPL), Netflix (NFLX) and Alphabet—parent of Google (GOOGL) are known as the FAAMG or “The FIVE.” Microsoft sometimes substitutes for Netflix.

In 2020, we predicted a rotation out of the FAANG companies since they had raced so far and fast. Microsoft and Google continued to gain ground in 2021, with Facebook and Amazon modest growth rates that undershot the market.

So the FAANG stocks were not a bad bet in 2021, but they came very close. Analysts predict that investors will migrate their attention to other sectors in 2022, which would be beneficial for names like Tesla (TSLA).

Could we suggest boring consumer staples with dividend-enhanced returns as a safe haven in an inflationary world?

8. The chips: Where are they?

The continuing computer chip shortage will continue to have an impact on the stock market—not just in the technology sector. Most consumer durable goods now have a computer chip in them, so the scarcity is more significant than it used to be.

With almost-finished vehicles littering most of the city’s parking lots, just waiting for scarce computer chips that must be installed, it’s a wonder how Detroit’s streets haven’t turned into a traffic jam.

The shortage of Intel chips is expected to last until 2023, according to the company. That may be a good argument for purchasing chipmaking equities, but it might also be a better motivation to worry about the long-term viability of most other consumer discretionary names.

9. Elections

The most significant question of 2022 is the midterm congressional elections. Republicans are expected to do well in the midterms, as the incumbent president’s party typically loses seats. But the rhetoric appears to be getting increasingly partisan, raising concerns about unpredictable news, upheaval, or even bloodshed. This is the type of surprise that might frighten investors.

To Wrap Up

Many Americans have already resumed a standard existence, and while masks are still required by law and airline travel is yet to return to pre-pandemic levels, many people have already reclaimed their normal lives, so even if the pandemic fades out in 2022, there may not be much more room for the economy trends—or the stock market—to grow.